36+ How is borrowing capacity calculated

Lenders generally follow a basic formula to calculate your borrowing capacity. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

10 K

The key levers which determine your borrowing capacity power are these.

. Existing loans and commitments. If you want a more accurate quote use our affordability calculator. The first step in buying a property is knowing the price range within your means.

To estimate your borrowing capacity you should enter the number of borrowers ie. View your borrowing capacity and estimated home loan repayments. I am trying to use an excel formula to calculate the maximum amount that a person can borrow.

Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus. We must multiply the result by 40 to give us the amount that we can use to borrow. Calculate your borrowing capacity using this borrowing capacity calculator from Opes Property.

Subscribe to get the latest insider tips market updates and access to the hottest deals as they come on the market. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider. How many boxes do you need to move.

Your borrowing capacity is really made up of two elements 1 Servicing how much money will you have to pay the loan and 2 Contribution how much deposit do you have saved. Examine the interest rates. For a conventional loan your DTI ration cannot exceed 36.

How the borrowing power calculator works To calculate your borrowing power we take into account a couple of. Usually this can be calculated as follows. 02 8733 2083 email protected Buy.

Calculate your borrowing capacity using this borrowing capacity calculator from AQ Properties. Its calculated based on your basic financial information such as your income and current debt. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Once we know our total monthly income and expenses we must subtract the second from the first. Your borrowing capacity is the maximum amount lenders will loan to you. Estimate how much you can borrow for your home loan using our borrowing power calculator.

How does it work. Thus as part of calculating your borrowing capacity it is. Whether you will be applying for the home loan by yourself or with someone else.

Calculate your borrowing capacity using this borrowing capacity calculator from My Logan Realty. I have used the PV formula and while it gives an approximate amount I. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

While there is a standard formula lenders follow lenders may assess your income or expenses. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Your borrowing capacity is the maximum amount lenders will loan to you.

No credit check is involved nor is it a guarantee of the approved financing which you may.

Sc 20201231

How To Start Building Credit Or Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

10 K

Sc 20201231

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

2

Sc 20201231

2

Sc 20201231

Sc 20201231

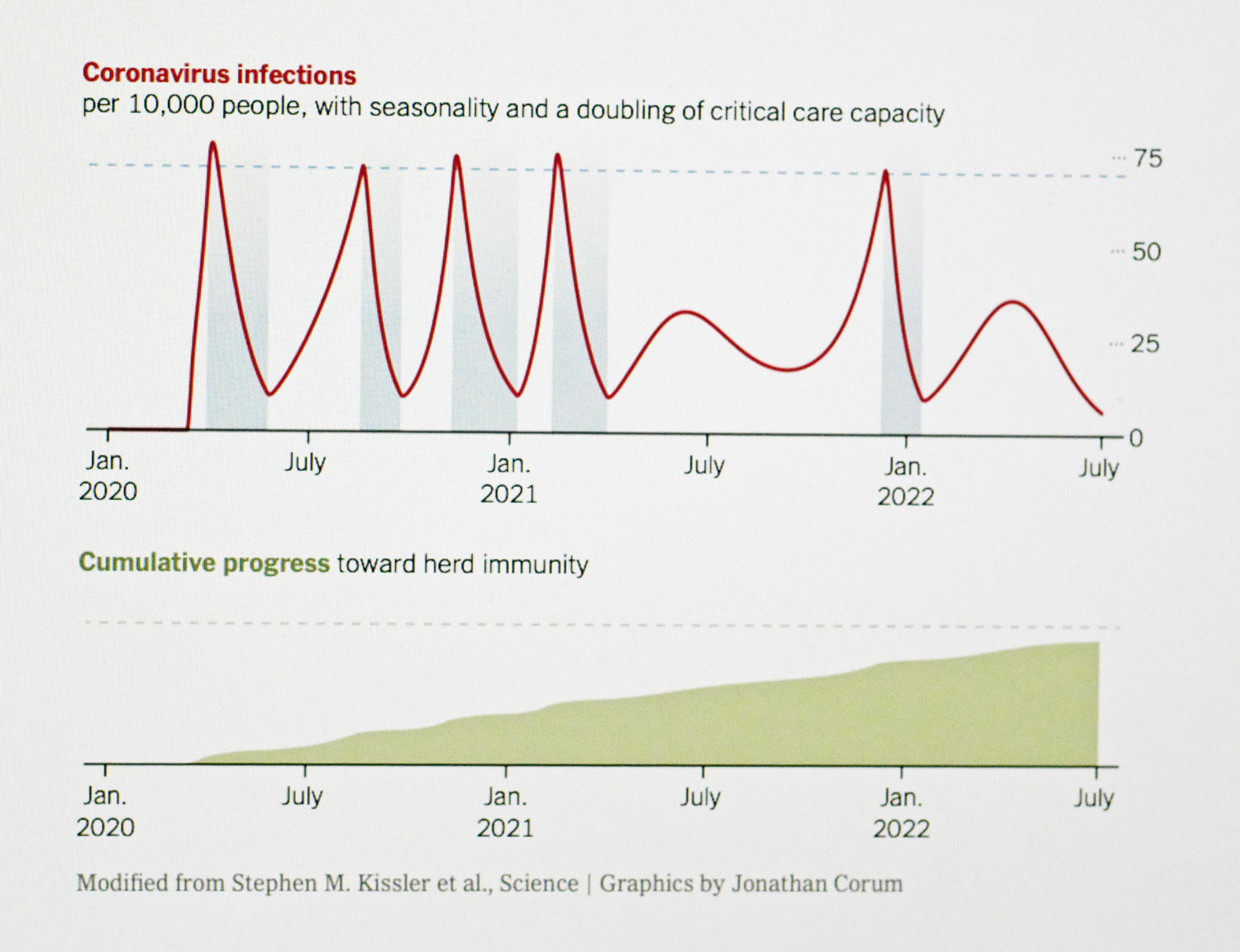

Covid Cyclical Seasonal Graph Jpg

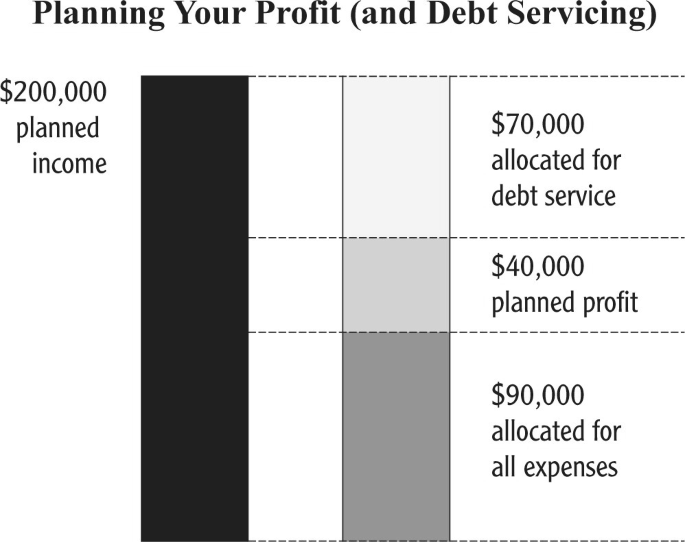

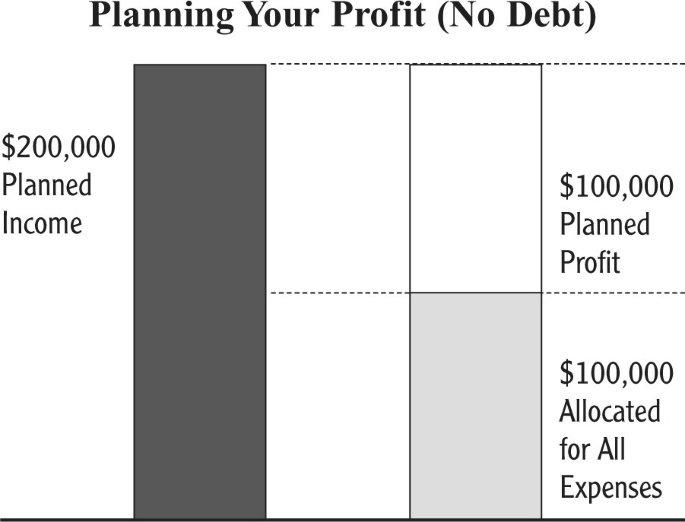

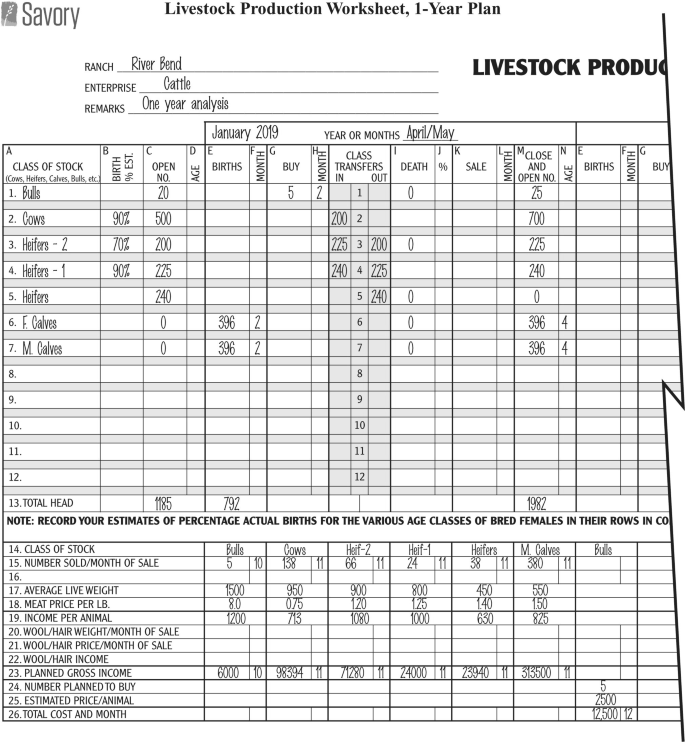

Generating Lasting Wealth Springerlink

Generating Lasting Wealth Springerlink

All Gens Eevee An Introduction To Ev S Smogon Forums

Free 6 Bank Loan Proposal Samples In Pdf

Generating Lasting Wealth Springerlink

What Is An Open House By Appointment Only In Nyc Hauseit