Average interest rate for compound interest

You do not need that funds for another 20 years. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

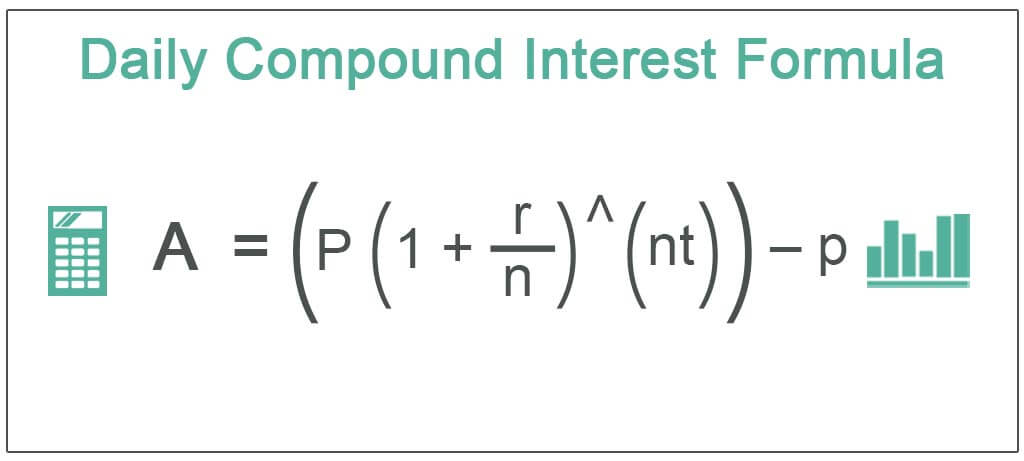

Daily Compound Interest Formula Calculator Excel Template

Because so many different lending institutions offer such a wide range of small business loan ratesand use so many different ways to express these ratesits tough to say what the overall average business loan interest rate is.

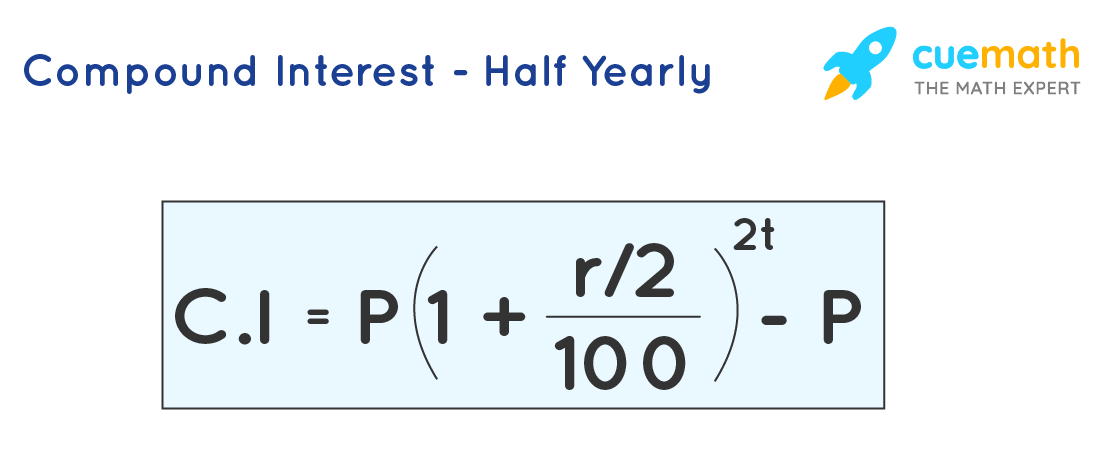

. The interest typically expressed as a. For example if interest is compounded half yearly then rate of interest would be R 2 where R is the annual rate of interest. Compounding frequency could be 1 for annual 2 for semi-annual 4 for.

Compare for example a bond paying 6 percent semiannually that is coupons of 3 percent twice a year with a certificate of deposit that pays 6 percent interest once a yearThe total interest payment is 6 per 100 par value in both cases but the holder of the semiannual bond. Many online banks have savings rates higher than the. Why lend with Compound.

CIT Banks Money Market account has one of the highest compound interest rates of any bank. This lets us find the most appropriate writer for any type of assignment. In its December 2014 statistics release the Bank for International.

While the rate you can earn differs by token on this platform its not uncommon to see rates of 3 or higher on certain tokens. Find out the initial principal amount that is required to be invested. Liquidity pools make it simple to lend to borrowers on this platform.

Consumers pay for a variety of different financial productscredit cards included. The formula for calculating average annual interest rate. The Federal Reserve keeps tabs on the average interest rate that US.

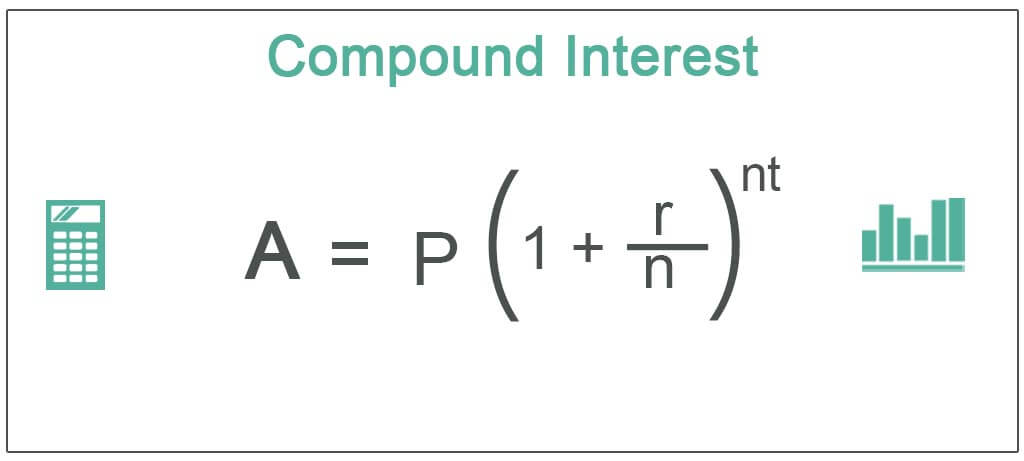

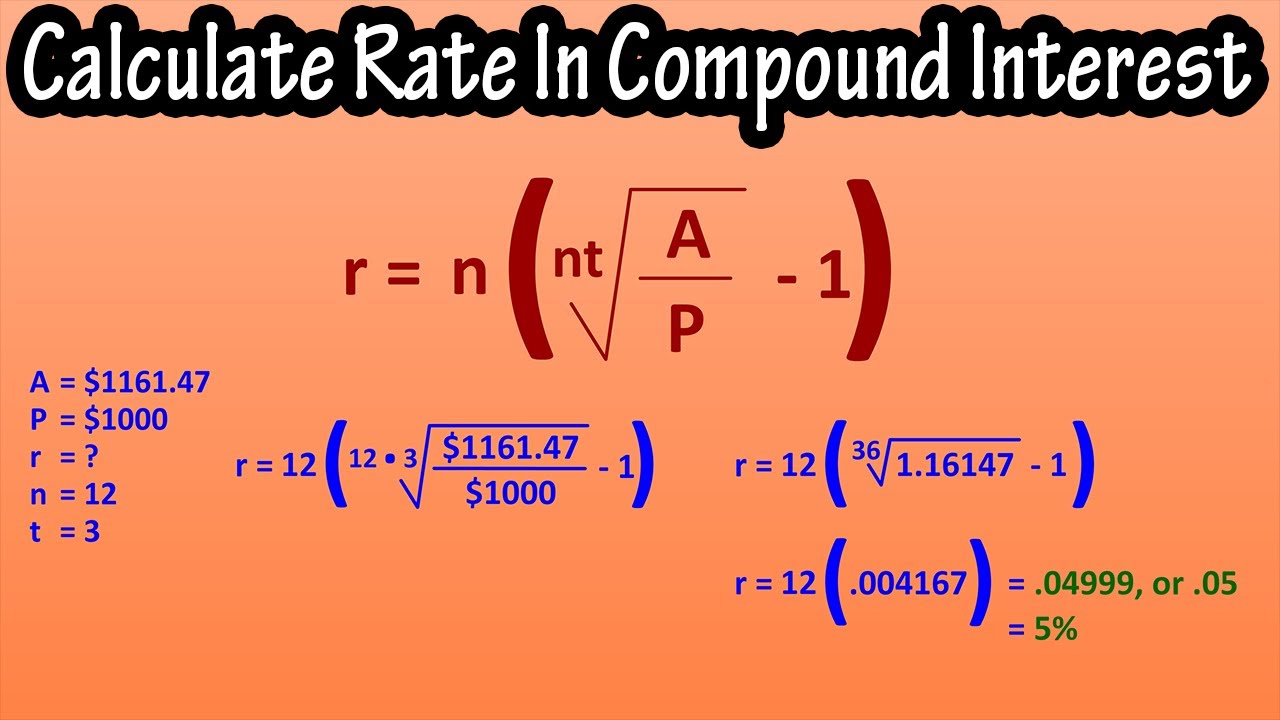

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. This move follows a 75 basis-point hike in. For used cars the average interest rate.

To compute compound interest we need to follow the below steps. Most equity release products have the potential to incur compound interest but you wont pay equity release compound interest on a Home Reversion Plan. In particular it is a linear IRD and one of the most liquid benchmark productsIt has associations with forward rate agreements FRAs and with zero coupon swaps ZCSs.

On July 27 the Federal Reserve announced another big rate hike raising the federal funds rate by 75 basis points bps to a range of 225 to 25. For example if we have to calculate the interest for 1 year then T 365. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account. Consumers with good or excellent credit may find average loan interest rates as low as 103 percent whereas those with average or poor credit will pay a considerably higher average rate.

The average annual returns of VFIAX for the period from 2010 to the end of 2019 were 1412. Average annual rate of return. Annualized Rate 1 ROI over N months 12 N where ROI Return on Investment.

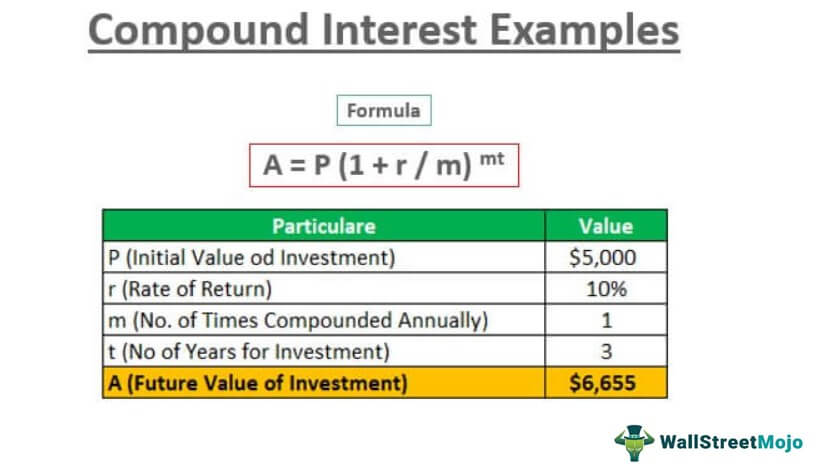

Lets say you have 10000 from a lottery and want to invest that to earn more income. With business loan rates falling as low as 3the best rate. 125 Compounding Annually.

Compound interest includes interest earned on the interest that was previously accumulated. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Say you have an investment account that increased from 30000 to 33000 over 30 months.

Thats because the way its structured is so that your. How to Use the Compound Interest Calculator. 10481 1 r.

What is the highest compound interest rate at a bank. You approached two banks which gave you different rates. APR or annual percentage rate is a calculation that includes both a loans interest rate and a loans finance charges expressed as an annual cost over the life of the loan.

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. What is the compound interest rate on this. The national average interest rate for savings accounts is 013 percent according to Bankrates Aug.

At the end of the first year youd have 110 100 in principal 10 in interest. The Equity Release Council noted in its Autumn 2022 Market Report that the average interest rate for Equity Release is 426. In May 2022 the average credit card.

Compound Interest Explanation. In finance an interest rate swap IRS is an interest rate derivative IRDIt involves exchange of interest rates between two parties. Jefferson earned the annual interest rate of 481 which is not a bad rate of return.

Most formal interest payment calculations today are compounded including those for this calculator and any following reference to the interest rate will refer to compound interest rather than simple interest unless otherwise specified. Interest is the cost of borrowing money where the borrower pays a fee to the lender for the loan. The average car loan interest rate was 386 for new cars according to Experians State of the Auto Finance Market report in the fourth quarter 2021.

Simple Interest vs. Daily Compound Interest Formula Example 2. 31 weekly survey of institutions.

Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one. The average business loan interest rate is difficult to define exactly. In other words.

In an account that pays compound interest such as a standard savings account the return gets added to the original principal at the end of every compounding period typically daily or monthly. Thought to have. If interest is compounded daily rate of interest R 365 and A P 1 R 365 100 T where T is the time period.

Lenders earn interest in the same token that was offered to the liquidity pools. The more frequently interest compounds within a given time period the more interest will be accrued.

Compound Interest Definition Formulas And Solved Examples

How To Calculate Compound Interest And Simple Interest Examples And Step By Step Solutions Gcse Maths Compound Interest Math Compound Interest Math Formulas

Compound Interest Formulas Derivation Solved Examples

Compound Interest Formulas Derivation Solved Examples

Compound Interest Definition Formula Calculation Invest

Compound Interest Definition Formula How It S Calculated

C Program To Calculate Compound Interest Coderforevers Programming Tutorial Programming Humor C Programming

Compound Interest Examples Annually Monthly Quarterly

Compound Interest Has Often Been Dubbed As One Of The Wonders Of The World But What Does Compound Interest Have To D Simple Interest Compound Interest Loan

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

How To Solve For Or Calculate Rate In Compound Interest Formula For Rate In Compound Interest Youtube

Daily Compound Interest Formula Step By Step Examples Calculation

Interest Rate Formula Calculate Interest Rate Chart Interest Rates Math Charts

These 3 Charts Show The Amazing Power Of Compound Interest Investing Savings Chart Compound Interest

Compound Interest Calculator Debt Solutions Interest Calculator Compound Interest